37+ is mortgage insurance tax deductable

SOLVED by TurboTax 5841 Updated January 13 2023. Also your adjusted gross income cannot go over 109000.

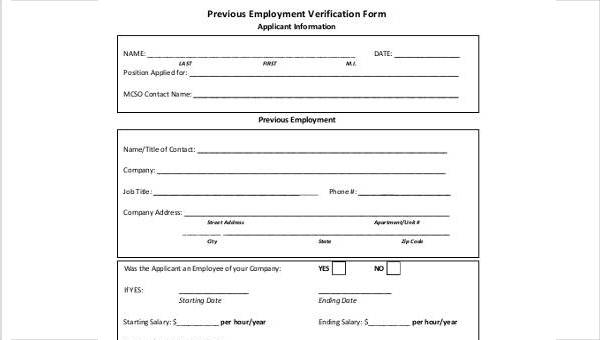

Free 37 Verification Forms In Pdf

Web Can I deduct private mortgage insurance PMI or MIP.

. Web FHA mortgage insurance is subject to some different lender rules than conventional mortgage insurance but is treated the same for tax purposes. Web This deduction allows you to claim the total amount paid toward your mortgage interest within one year. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses.

Once your income rises to this level. Discover Helpful Information And Resources On Taxes From AARP. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

The itemized deduction for mortgage. Web You can only deduct the upfront mortgage insurance premiums that you paid out-of-pocket at the loan closing if your adjusted gross income meets IRS limits. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web Is mortgage insurance tax-deductible. Web Mortgage insurance is required on some loans to protect the lender if you default on the loan. This coverage may be tax-deductible if you itemize your tax return.

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Connect Online Anytime for Instant Info. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000.

Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Connect Online for Tax Guidance. For married couples filing separately if each partner.

Ad Ask a Tax Expert About Tax Deductible Limits. Web You may not be able to deduct mortgage insurance payments if your income exceeds 54500 for individual filers or 109000 for married couples. Ask a Verified CPA How to Benefit from Tax Deductibles.

Homeowners who bought houses before. Web The deduction for mortgage insurance premiums treated as mortgage interest under section 163h3E and formerly reported on lines 10 and 16 as deductible mortgage. Web Homeowners who have sufficient mortgage interest and other qualified expenses to get above the standard deductions of 25900 married filing jointly or.

This income limit applies to single head of household or married. Homeowners can deduct the interest paid on the first. ITA Home This interview will help you.

Web If your adjusted gross income for the year is 109000 or more youre not qualified for a PMI deduction. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Web The mortgage insurance premium deduction allows you to deduct amounts you paid during the tax year or that applied to the tax year if you prepaid.

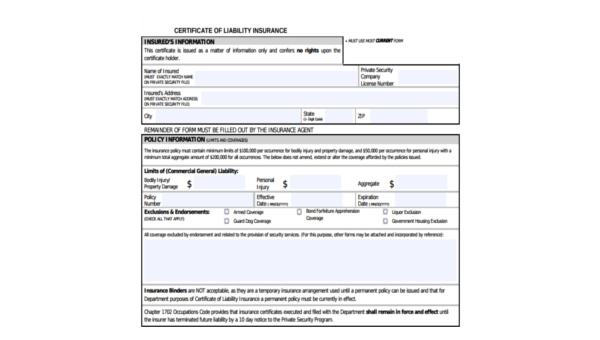

Free 6 Sample Certificate Of Liability Insurance Forms In Pdf Ms Word

5 Types Of Private Mortgage Insurance Pmi

Eztax Releases Budget 2023 Expectations Sees A Significant Shift

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction How It Calculate Tax Savings

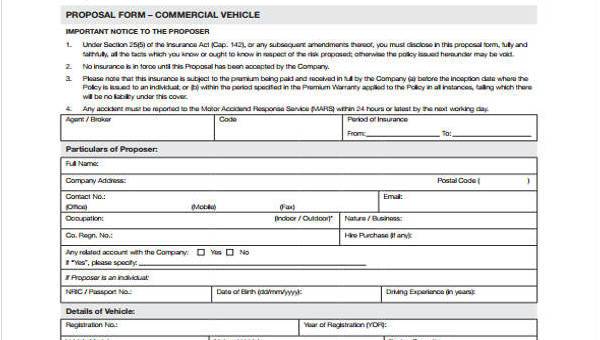

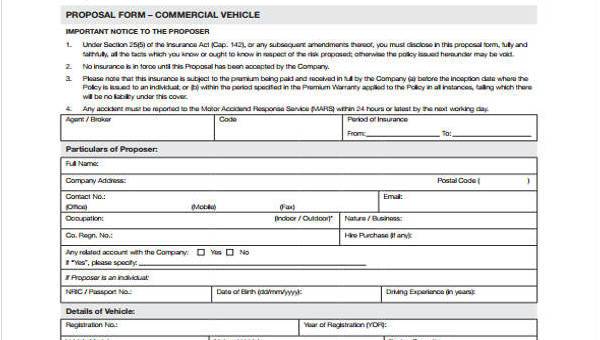

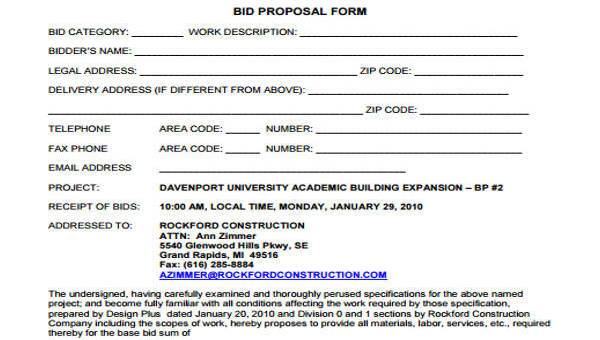

Free 37 Sample Free Proposal Forms In Pdf Ms Word Excel

How To Deduct Private Mortgage Insurance Pmi For 2022 2023

What Is Private Mortgage Insurance Pmi And How To Remove It

American Economic Association

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Free 37 Proposal Forms In Pdf Excel Ms Word

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Is There A Mortgage Insurance Premium Tax Deduction

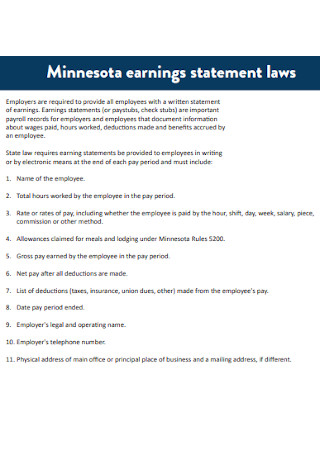

37 Sample Earnings Statement Templates In Pdf Ms Word

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

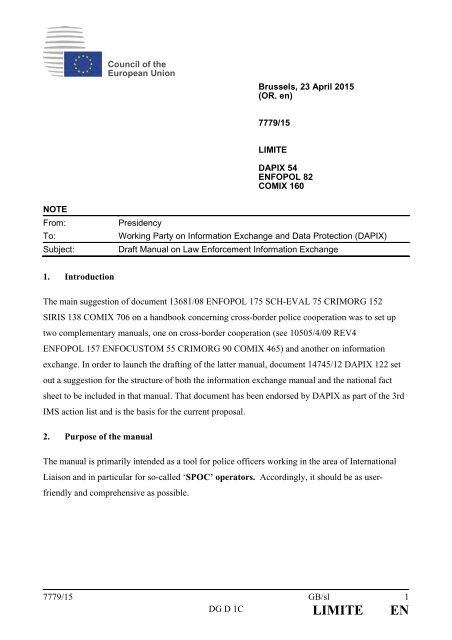

Eu Council Manual Law Enforcement Information Exchange 7779 15